HOUSING FOR ALL – ACTUAL SAVINGS UNDER PMAY AND THE BUDGET

If you buy a house, the central government will lend support with over Rs 2.40 lakh up front.

The Union government has given a range of subsidies on interest payment to home loan borrowers, with a household income of up to Rs 18 lakh. The subsidy amount will be paid to the housing finance companies upfront.

This policy has a dual purpose-one, drive up the sale of houses to revive the sector and, two, achieve Prime Minister Narendra Modi’s ambitious programme, “Housing for all by 2022“.

At present, subsidy is given to lowincome households, with a total annual income of Rs 6 lakh per annum. The new scheme’s outline was announced by PM Modi on the December 31 in his Address to the Nation, whose details have been finalised only now and are likely to be notified soon. The pro gramme will be covered under “Pradhan Mantri Awas Yojana“ (PMAY).

A government source said that though the scheme is to be notified now, the benefits under the scheme were already launched from January 1, 2017, itself. Thus, all those who bought houses on and after January 1, 2017, are entitled for the benefit.

Apart from this, all the schemes of subsidy will now be available on a 20year home loan, including the one for low-income group, which was earlier for 15-year home loan only.

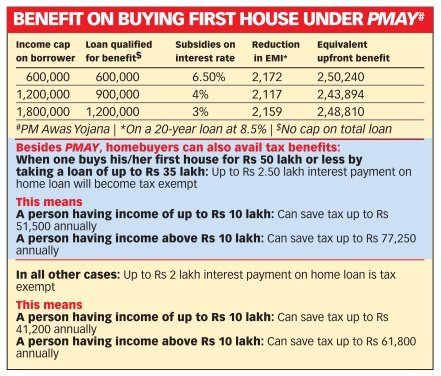

Under these schemes, an interest subsidy at the rate of 4% for loans of up to Rs 9 lakh will be extended by the government to those whose household’s annual income is up to Rs 12 lakh. Similarly, an interest subsidy at the rate of 3% for loans of up to Rs 12 lakh will be given to those having a household income of up to Rs 18 lakh.

At present, the government is already giving a subsidy of 6.5% on a loan of up to Rs 6 lakh to those whose household income is less that Rs 6 lakh per annum.

This does not mean that the loan amount is capped. If a person with a household income of Rs 10 lakh borrows Rs 35 lakh to buy a house, he will still get the mandated 4% interest subsidy on Rs 9 lakh. Suppose that this person borrows the amount at 8.5%, he will then pay an EMI at 4.5% on Rs 9 lakh plus an EMI at 8.5% on the rest of the amount, Rs 26 lakh in this case.

Owing to the subsidies from the government, his effective EMI will be reduced by Rs 2,117, if the repayment period is 20 years. This subsidy will not be given every month to the lender. Instead, the government will pay around Rs 2,43,894 to the lender upfront, so that the EMI at the contracted rate falls by this amount.

The interest subsidy at the rate of 4% for a 20-year loan of Rs 9 lakh results in a reduction of EMI by Rs 2,117, when the home loan is taken at 8.5%. According to the scheme, there is no restriction on the loan amount that such a homebuyer with an annual household income of Rs 12 lakh can avail, except that the 4% subsidy is available on Rs 9 lakh alone.

But if the borrower’s income is more than Rs 12 lakh per annum but up to Rs 18 lakh, he can get 3% subsidy on only an amount of up to Rs 12 lakh, from his total home loan. In this also, there is no cap on loan amount or the value of the property that such a person can buy. However, the maximum benefit in this leads to a reduction in EMI by Rs 2,159, if borrowed at 8.5%, which is equivalent to reduction in the borrowed capital by Rs 2,48,810.

For a lower-income group household earning up to Rs 6 lakh per annum, the interest subsidy is 6.5% on an amount of up to Rs 6 lakh from the total loan amount, which reduces EMI by Rs 2,172, if the loan is borrowed at 8.5%. This is also equivalent to reduction in borrowed amount by Rs 2,50,240.

Even after availing this benefit under PMAY, one can avail income tax benefits on the home loan, which can go up to Rs 61,800 if a person’s income is in the 30% tax bracket and up to Rs 41,200 if the income is in 20% tax bracket, as the person is allowed to deduct the interest payment of up to Rs 2 lakh from his or her taxable income.

But if a person is buying his or her first house at a capital value of less than Rs 50 lakh by taking a loan of Rs 35 lakh or less, the benefit will increase substantially. In this case, a person having a household income in the 30% marginal tax bracket can get a maximum annual tax benefit of Rs 77,250, while those whose income is in 20% tax bracket will be able to save up to Rs 51,500 annually. In this case, too, a deduction of Rs 2.50 lakh is allowed.

National Housing Bank and HUDCO are the nodal agencies to implement the schemes. At present, the scheme for LIG is being rolled out. Till December 31, 2016, the government has given subsidy to around 18,000 housing units with the total subsidy disbursal amounting to around Rs 310 crore.

A senior NHB official said that following the revision of the scheme to include middle-income group households, the disbursal rate is likely to pick up.